European Space Sustainability by Giovanni Sylos Labini - President of AIPAS

With the Lisbon Treaty ““Europe has decided to develop its own operational Earth observation capacity in order to reflect the EU’s growing responsibility in European and world affairs” COM(2009) 223 final.

1 Foreword

With the Lisbon Treaty ““Europe has decided to develop its own operational Earth observation capacity in order to reflect the EU’s growing responsibility in European and world affairs” COM(2009) 223 final.

Has normally happens in treaties each word have been carefully weighted, making some strong point:

- Europe would like be develop an independent EO system

- This system should be operational

- This capacity should reflect the global role of Europe

Other parts of the referred document clarify that design drivers of this system should be the monitoring of the Environment at European and Global Scale, the Emergency management and response, the Security of Eu citizens. Copernicus was born.

In recent time, a more focused approach emerged on the so-called Space Economy, of which EO is a relevant part. This issue is also strongly highlighted by competing forces: the need of liberate innovation in Europe, the long-term sustainability of Copernicus, the flattering budget of Space in Europe.

On the top of this the fear that the forward fetched Free Open Data Policy, could backfire a dispersed and unprepared European Industry, leaving the ground to the big Internet operator from abroad.

Our thesis is that all the conditions exist to boost specific capabilities of Europe in Space, assure long term sustainability of Copernicus, and use the best practices developed in this area to be successful in other space domains.

2 Follow the Money

Several pre-impact studies of Copernicus have been carried out in the past, for sake of simplicity we will refer in this paper to the GIO-LOT 3 made for the Commission by SpaceTec. As shown in Fig. 1

Copernicus will generate 1.8 B€ in downstream services by 2030. The major impact on occupation will be so in this area, with an estimated 12000 new jobs created in this sector respect only 4.500 new jobs created in the Up-stream and Mid-stream.

If we trace these jobs in the expected application area, we will easily see that a large majority of this demand will be generated by different Public Administrations, a possible share at 2030 is shown in Fig. 2.

All this looks an attractive picture for the future of EO in Europe, but the devil is in the details.

3 Two Questions to Be Answered

In the slang of marketing studies the 1.8 B€ referred to the downstream market is a potential addressable market. In few words is a demand that could materialize, and that should be satisfied by some industrial capacity. So the two questions are:

- Is European DS industry ready to intercept this demand?

- Considered that 80% of this demand is public, are EU PA aware?

Unfortunately the reply to this two question is NO.

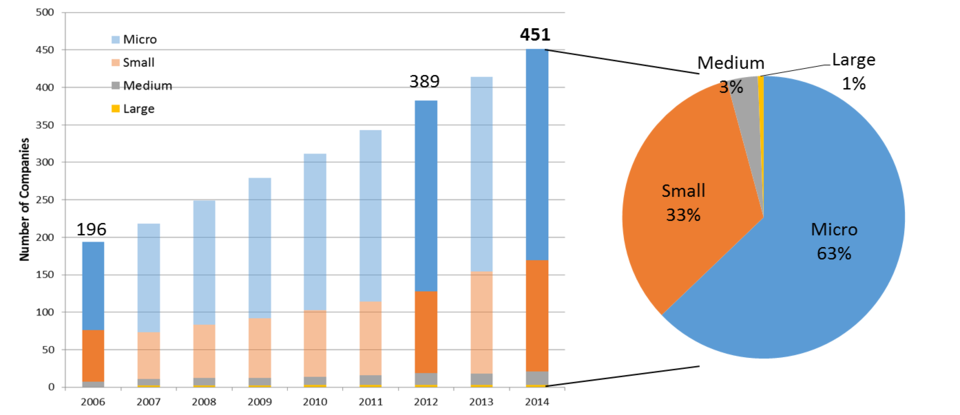

As demonstrated by the EARSC 2015 study on EU downstream industry, this industry is fragmented and dominated by micro, small and medium operators (Fig.3)

And most important this industrial structure is rather stable in the last 10 years.

For what concern the demand of services from the PA, it’s clear that the use of EO to these needs fulfilment is there, but a big effort should be done in order that Public Demand could be expressed. Even in this case the risk is high that other than EU downstream industry, namely Google or Amazon, could rapidly put in place solutions, putting Europe in the discomforting position of having planted the vineyard, letting others producing the wine.

4 How Competitors Succeeded?

In the early 90’ the USA Department understood that the evolution of the global scenario would generate a dramatic increase in the demand of Image Intelligence Imaging products. So the Next View approach that now feeds the High Resolution commercial venture in USA start to take momentum. USA went through some logical step in order to enable this capacity.

As a first move they established a favorable regulatory framework, adopting by law the acquisition of commercial imaging for the fulfillment of a reasonable part of DOD needs. Then defined, progressively longer period, establishing a long term “Anchor Tenant” to help attract outside investors. On the top of this gave a wide mandate to selected operators in order to establish suitable channels for commercialization of excess capacity. In this way the USA government established mutual trust and long term outlook with the service operator. It must be noted that this approach strongly polarized North American space industry in mastering Image Intelligence mission, leaving other areas now covered by Copernicus open for competition.

5 Which Way for Europe ?

We in Europe can retain something from the USA approach, but cannot ignore the difference that exist. At the opposite EU must capitalize on differences and remove patiently the obstacles to fulfill the Lisbon treaty objectives.

First of all Europe can’t afford a defense anchor tenancy, for political and cultural reasons we are not in the position of establishing a common EU policy on image intelligence. Furthermore, the DoD approach targeted a single application, single business. At least with Copernicus, EU, ESA and MS have in scope multiple demand and applications. Finally the US huge military space budget developed a strong family of actors in the business, while the European DS industry, as noted is composed by small and medium enterprises.

In order to succeed we must follow a different approach, leveraging on the specific characteristic of our continent, transforming weakness in competitive advantage.

So Europe must leverage on diversity. Europe is the most complex multistate union in the world counting 28 members states (with specific ambition, culture, lifestyle…), with 24 different languages. These means naturally multilingual, multi-culture services, build around thousands of potential user. Moreover Copernicus have been designed to respond to serious problem, largely shared at global scale , not only IMINT, but environment, clima, risk, security, agriculture etc. These issues are in very high position in the members’ states agenda, and largely justify the use of space for mitigation, but they are concern also for the rest of the world, with some emphasis on developing economies offering a blue ocean of opportunity for EU downstream industry to flourish, if enabled.

An issue on which we must follow the US is the regulatory framework. Regulation can a very strong ingredient in the recipe for innovation. EU have already delivered some piece of laws relevant for DS economy, two example in this direction are the Inspire Regulation and the Copernicus Regulation. Nevertheless, efforts that are more explicit must be put in place in order to push all the public authorities of EU member states to actively use downstream services in their policies for environment, security and risk mitigation. This approach, together with the long-term commitment on Copernicus data, will make more attractive downstream services for investors.

Then we must assure that a solid EU based downstream industry emerge. Many success stories and business literature, suggest the vertical integration as one of the most effective response to a growing demand. This is normally the case of manufacturing industries, where a lot of economy, and margins, emerge by integrating vertically capabilities and making economies on general spending, management, R&D etc…Unfortunately this is not the case for Downstream Services.

All the big player in space, in Europe and outside, come from the “HARD” part of the business, and understand that making money from EO is possible only if they find a way to transform Data in useful information for their customer. In doing this they have normally few or not at all experience, keen as they are to a frantic technology push, a notable organization rigidity, a strong inclination in looking the world through the deformation lenses of technology.

Downstream services claims for flexibility, user interaction design, open innovation approach that simply are not in the DNA of major space LSI. The solution of acquisition of downstream sme’s has proven not to be viable, normally the incumbent kill the few competitive advantages of the target destroying value.

The IT player will face other kinds of difficulties. EO services are not trivial to implement, even for simplest services a steep learning curve exist not easy to overcome from new entrants without the know how of some decades of R&D in the area.

However some best in class downstream SME’s have been notably resilient in their market, developing notable skills in service development, implementing best practices for user up-take, capitalizing on their user proximity, agile and flexible in following innovation.

A set of these companies could work as an accretion nucleus for a NewCo in the downstream industry adding dimension to the above-mentioned competitive advantage. Some creative strategic thinking should be put in place in order to trigger the merge success delivering a new subject stronger than their building blocks. The idea is start from a set of “best in class” companies, with complementary skills and business model, based in different member states of EU

In order to make this possible the EU and Members States should act in an entrepreneurial way. Mariana Mazzucato correctly states: “If we actually look at the few countries that have achieved smart, innovation led growth, you’ve had this massive government involvement”(From Lunch with the FT: Mariana Mazzucato FT.com). If we wait for private funds to invest in this venture, we are dreamers.

The EU and member states should made a better use of existing resources, aligning different funding option: National, H2020 & Copernicus, ESAESIF- Regional and Multiregional. At the same time Long-term, “Anchor Tenant” initiatives should be put in place to attract “patient” investors. Invited to this party must be the European Investment Bank, national investing funds and specific investments facilities like the Junker Fund.

6 Conclusions

As we have seen a big opportunity of growth exist in the Copernicus Downstream Services. This growth, if implemented by European industry, could assure in the long term the sustainability of the Upstream and his evolution. Unfortunately, the EU EO industry is not in the shape of intercept as it is this opportunity. To overcome this drawback a long-term government led investment in downstream is vital for upstream survival. Acting this way EU could establish a competitive advantage on global scale, leveraging on diversity and on the delay of competitors in this market.