ESA to aid recoveries from natural disasters

A global system that uses space data to provide early warnings of natural disasters will help people and businesses that have suffered losses by supporting the insurance industry.

The Global Event Observer will be developed by geospatial imagery and insurance intelligence consultancy McKenzie Intelligence Services with the support of ESA.

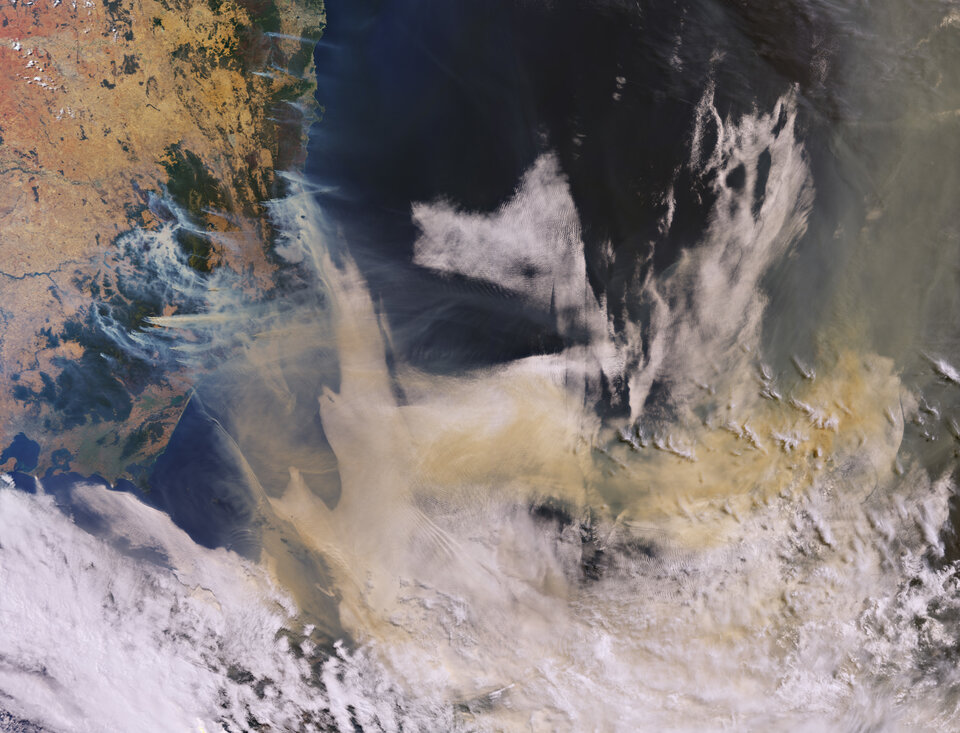

Changes in climate are associated with an increase in the frequency of extreme weather events, such as the severe flooding in the UK last winter and the widespread Australian bushfires in early 2020, which have devastating and long-lasting impacts on society.

Insurers require accurate data to assess the damage caused to support insurance claims and aid recovery from such adverse events. Early warning systems can also be used to predict areas prone to flooding, as well as the track of bush fires, enabling insurers to protect peoples’ lives and property.

McKenzie Intelligence Services uses data from many sources to provide an accurate and reliable picture of extreme events. Since 2016, the company has acted as the geospatial imagery and intelligence provider for Lloyd’s of London, the world’s oldest and most prestigious insurance market.

The Global Event Observer will build on the company’s current capabilities. It will enable the use of highly accurate geotagged data from many sources, such as information from satellites, the Internet of Things, and aerial imagery, to provide early warnings of loss events, creating opportunities for decision makers to mitigate against the financial and human costs of catastrophes – as well as supporting insurance claims workflows to become more efficient.

Forbes McKenzie, chief executive and founder of McKenzie Intelligence Services, said: “The value of what McKenzie Intelligence Services can potentially deliver to the market could be truly remarkable in providing very early data from catastrophes or other loss events quicker than the insurance industry has been able to deliver before.

"The possibility of Lloyd’s, insurers, brokers, third-party administrators and ESA exploring the future applications of space data and processing is another exciting prospect for the industry.”

Vicky Mills, chief product officer at McKenzie Intelligence Services, said: “The features of a global event observer are far reaching, we can automatically ingest risk data, store and monitor it against insured perils, using a huge number of data sources from around the world. Once a trigger event happens, we send that data back to the client system and they act upon it in either their exposure management, claims or other workflows, greatly speeding these up workflows and providing very accurate data from the ground.”

Nick Appleyard, head of ESA space solutions, said: “ESA sees a significant opportunity for space to support financial services, in particular the insurance sector, since space-derived data allows a rapid assessment of both risk and damage over a wide area of observation. We’re excited to support McKenzie Intelligence Services for this venture with their partners in the insurance sector, which promises the automatic generation of event-driven claims, based on triggers written into the insurance contract and underpinned by cost-effective and trusted information that can be used to remotely investigate and assess the situation on the ground"

Funding for the McKenzie Intelligence Services demonstration project is provided by ESA Business Applications under the ESA Space Solutions umbrella.