Growth and employment in the global space sector

In 2014, satellites for operational services in telecommunications, observation, navigation and meteorology, formed the baseline of global space activity. They took the greatest share of the 296 satellites placed in orbit over 92 launches.

A key feature of the worldwide space activity is the predominance of domestic procurement that establishes captive markets, with particularly limited import and export activities.

During the past 25 years, the open market has expanded, giving way to global competition, with non-domestic procurement representing 21% of the global space activity in terms of mass launched in 2014.

Eurospace, the trade association of the European space industry, asserts that the share of non-domestic procurement was more important for launch service supply than for spacecraft supply. According to the European Space Industry Association, two key factors explain the evolution of the open market: the emerging demand from countries without manufacturing capabilities (47% of non-domestic satellite procurements in 2014) and the privatisation of satellite operators (58% of non-domestic satellite procurements in 2014).

Indeed, while demand for space systems becomes more international, suppliers are still concentrated in only a few countries.

Open markets are also almost exclusively related to the purchase of telecommunications systems: satcom represented 87% of non-domestic launches and 84% of non-domestic spacecraft procurement.

Though Russia and America remain worldwide leaders, in the last decade the impressive growth of Chinese activity in space made China the third launch power both in terms of number of launches and mass launched in 2007.

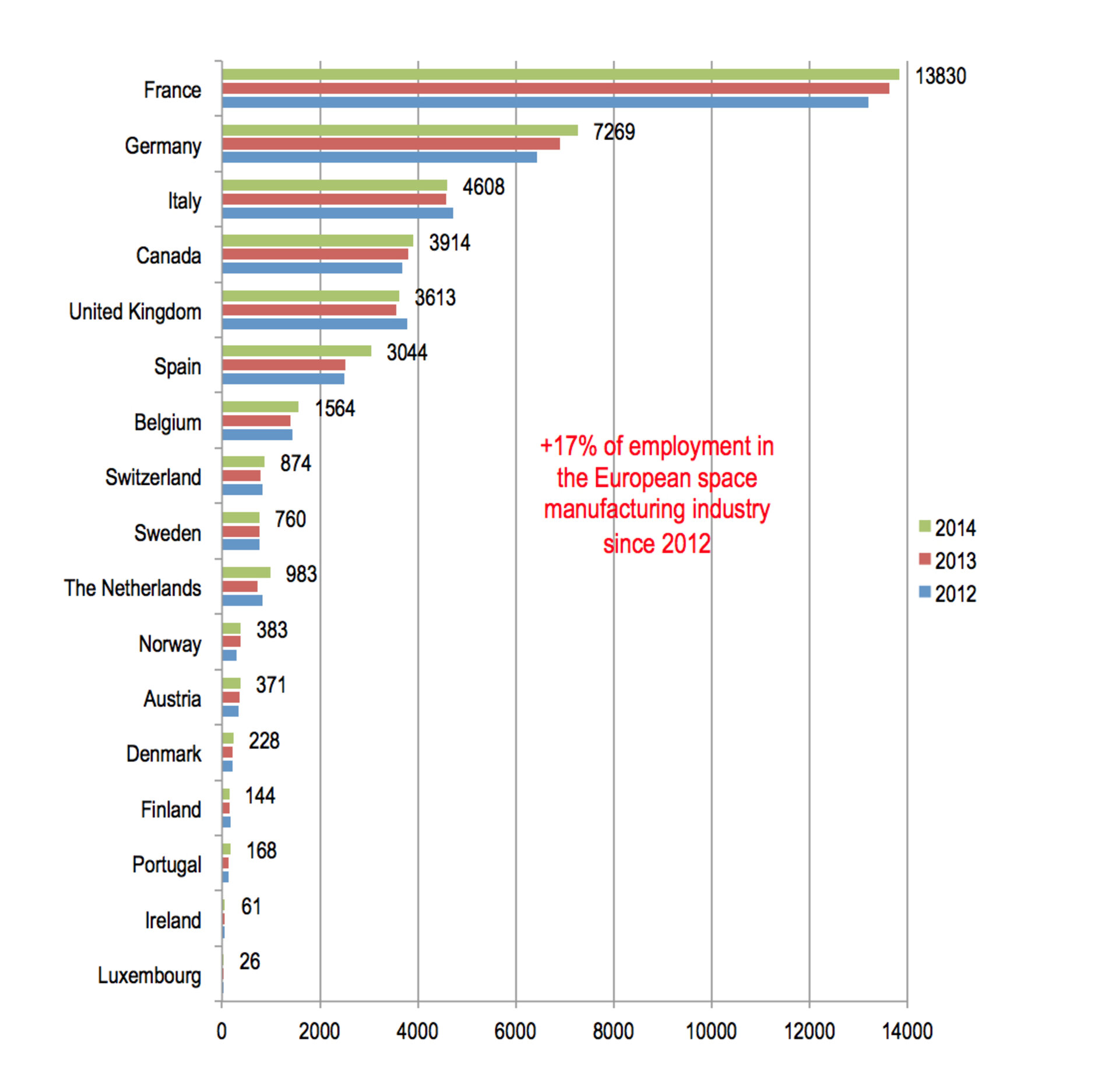

Europe was the third power in terms of mass in 2014. New countries also started developing space industrial capabilities, such as Argentina, and South and North Korea, with ultra-small satellites and more particularly cubesats giving them the opportunity to build their own spacecraft without advanced competences of large industrial facilities.

On the commercial market, the USA and Europe capture the large majority of demand. This exposes European companies to commercial market variations and requires Europe to remain constantly competitive to maintain its level of industrial activity.

To read the rest of this article and learn about growth and generating employment in the global space sector, click here or on the link to the right of this page.